marin county property tax rate

You will need your eight-digit parcel number example 123-456-48 in order to view the Assessor Parcel Map page online. Cook County collects on average 138 of a propertys assessed fair market value as property tax.

Transfer Tax In Marin County California Who Pays What

Marin county property management for quality tenants in quality homes.

. Of the top 20 most expensive counties 55 are in New Jersey. You can locate your parcel number on your valuation notice tax bill deed or by calling the Marin County Assessor at 415 473-7215 or via email. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800.

Property Tax Bill Information and Due Dates. Secured property taxes are payable in two 2 installments which are due November 1 and February 1. Penalties apply if the installments are not paid by.

The property tax rate in the county is 078. Hamilton County has one of the highest median property taxes in the United States and is ranked 332nd of the 3143 counties in order of median property taxes. Our talented team will do everything possible to provide a great rental experience.

Marin County Property Tax Search Mendocino County Property Tax Search Merced County Property Tax Search Monterey County Property Tax Search. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year.

8 counties pay 10000 or more in property taxes. Secured property tax bills are mailed only once in October. Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes.

Two Family - 2 Single Family Units. That is nearly double the. We also looked at the effective tax rate the property tax divided by the value of the home and the 5-year change for that rate.

Two Family - 2 Single Family Units. The median property tax in Hamilton County Ohio is 2274 per year for a home worth the median value of 148200. The average property tax increase over 5 years was 18.

If you have questions about the following information please contact the Property Tax Division at 415 473-6168. The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public. The Assessor Parcel Maps can be viewed on the Marin County Assessor-Recorder- County Clerk website.

Total tax rate Property tax. Here are some of our most interesting findings. Hamilton County collects on average 153 of a propertys assessed fair market value as property tax.

George Russell County Mails Out Yearly Marin Property Tax Bills Marin Independent Journal

How Big Is An Acre Of Land 14 Great Visual Comparisons Acre Visual Comparison

Marin Pilot Program Aims To Entice Landlords To Accept Section 8 Being A Landlord Entice Pilot

Marin Wildfire Prevention Authority Measure C Myparceltax

These Aren T The Words Of Bernie Sanders Or Aoc They Re The Words Of The Pope Pope Elderly Person Exercise Form

Mortgage Rates Fall 15 Year Fixed At Record 30 Year Mortgage Mortgage Rates Refinance Mortgage

Marin County Real Estate Market Report March 2022 Latest News

Why You Want Amazon To Be Your New Neighbor Amazon Cnn Money Plumas County

Marin County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

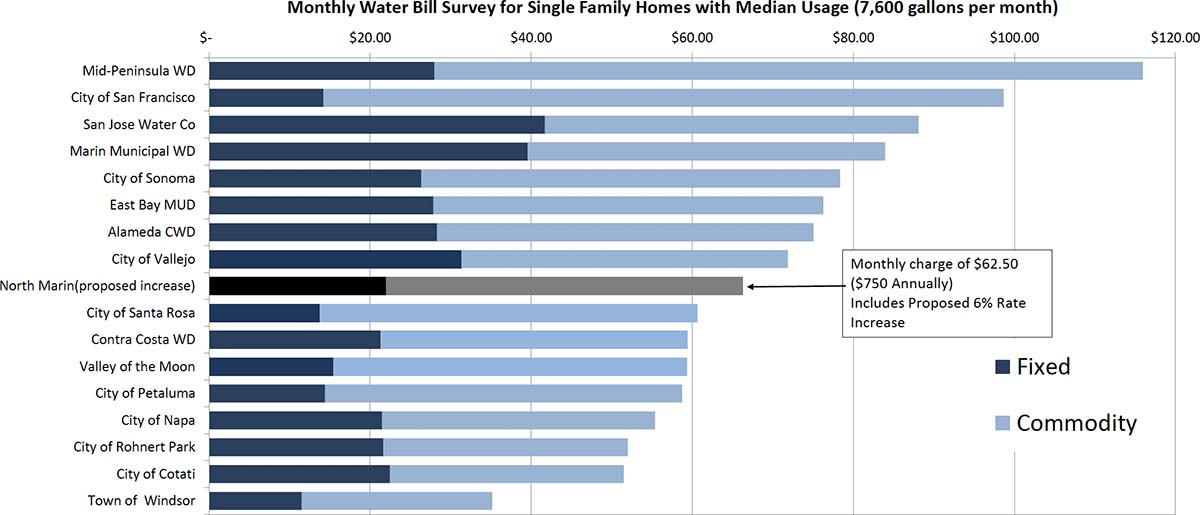

Rates North Marin Water District

Transfer Tax In Marin County California Who Pays What

Real Estate Is My Business Real Estate Buyers Real Estate Infographic Real Estate Trends

In Terms Of Real Estate Values One Marin County Zip Code Leapfrogged Bay Area Rankings Achieved 4 Nationally

Transfer Tax In Marin County California Who Pays What

Marin County Real Estate Market Report January 2018 Trends Market News Marin County Real Estate Real Estate Real Estate Trends

Marin Wildfire Prevention Authority Measure C Myparceltax

Real Estate Is My Business Real Estate Buyers Real Estate Infographic Real Estate Trends